Quick Summary: Looking for up-to-date full truckload (FTL) shipping rates in Canada for 2025?

This guide breaks down the key pricing factors that impact your FTL costs — including route distance, fuel surcharges, pallet count, seasonal trends, and accessorial charges. Whether you ship from Toronto to Calgary or Vancouver to Montreal, understanding the variables behind FTL pricing can help your business budget smarter and negotiate better rates.

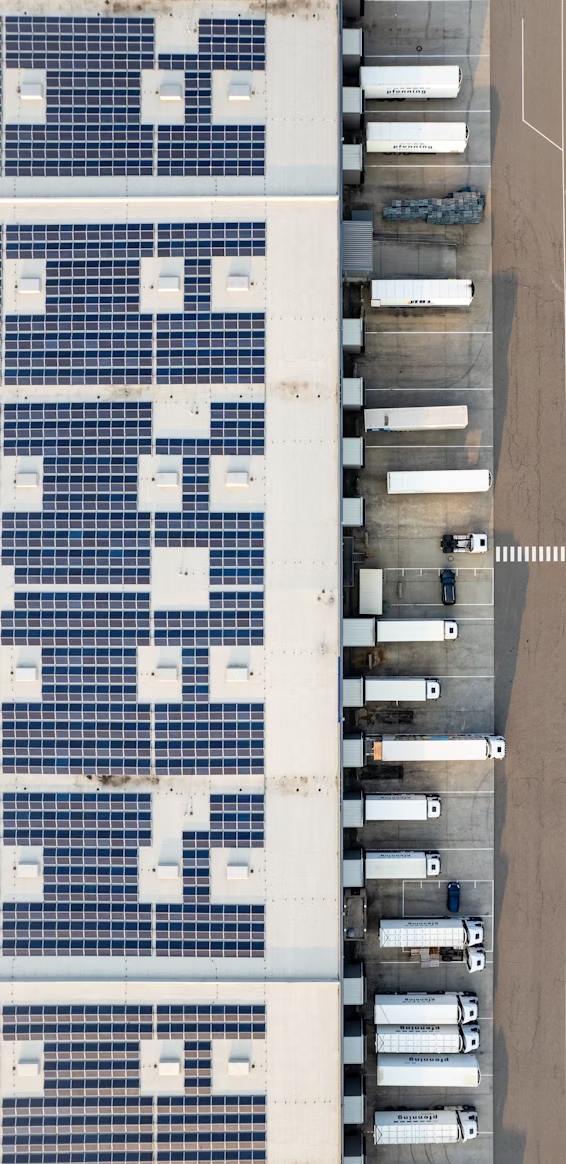

Why Full Truckload Shipping Rates Matter in 2025

Full truckload shipping remains a cornerstone of Canada’s freight transportation system. Whether moving goods from Vancouver to Calgary or Montreal to Halifax, companies across sectors—retail, manufacturing, agriculture, and distribution—rely on FTL to deliver large, consolidated shipments efficiently and safely. But for logistics managers and procurement teams, one of the most common questions is: What affects full truckload shipping rates in Canada in 2025?

Fuel Prices: A Major Variable in FTL Costs

The answer isn’t as simple as cost-per-mile. Several factors interact to determine the final price of an FTL shipment, and understanding these can lead to significant savings and smarter route planning.

To begin with, fuel prices continue to be a major contributor to overall shipping costs. As of mid-2025, diesel rates have fluctuated across provinces, driven by global market shifts and carbon pricing policies. While many carriers now apply a fuel surcharge to adjust for volatility, shippers in long-haul corridors like Vancouver to Toronto feel the greatest impact. Fuel-efficient fleets, such as those using modern Class 8 tractors or operating under green freight programs, often offer more stable pricing and fewer environmental surcharges.

Origin and Destination: Lane-Specific Pricing Trends

Another crucial variable is the lane itself—the origin and destination of the shipment. Intra-provincial lanes tend to be more predictable, while cross-provincial FTL pricing varies by distance, road conditions, and demand imbalance. For example, freight moving into rural or remote areas of Northern Ontario or Saskatchewan can be significantly more expensive due to deadhead mileage, where a truck returns empty. Conversely, high-volume lanes such as Toronto–Montreal often benefit from competitive pricing due to stronger freight density and consistent demand on both ends.

Carrier Capacity and Seasonal Demand Pressures

Carrier capacity also plays a role. As supply chain disruptions ease but labor shortages persist, capacity remains a challenge in certain markets. During peak seasons—such as pre-holiday retail surges or Western Canada’s agricultural harvest months—FTL carriers may implement rate increases to balance higher demand. Shippers who pre-book lanes, leverage volume contracts, or build relationships with carriers often benefit from more favorable and predictable rates.

Freight Type and Load Requirements

Load characteristics are another key cost factor. Heavy freight that approaches weight limits or awkward freight requiring special handling may incur added costs. Similarly, temperature-controlled full truckload shipments, common in food and pharma logistics, command premium pricing due to equipment availability and compliance protocols. Carriers must also consider loading and unloading times; delays at the dock can lead to detention fees, which get passed on to the shipper if not planned properly.

The Rise of Technology in Freight Pricing

Technology is increasingly influencing Canadian FTL pricing structures in 2025. Advanced TMS platforms, real-time freight quoting engines, and AI-powered route optimization are giving both carriers and shippers access to dynamic pricing models. These tools allow for more accurate estimates and allow shippers to compare rates across carriers instantly. Some platforms now incorporate sustainability scoring, helping businesses choose cost-effective and lower-emission routes or equipment.

Regulatory Factors and Green Freight Incentives

- Additionally, regulatory compliance continues to affect pricing. Provinces such as British Columbia and Quebec enforce emissions standards and infrastructure tolls that increase operational costs for carriers, which may be reflected in rate sheets. On the flip side, companies that qualify for government green freight incentives or invest in electric vehicle (EV) fleets may pass those savings to shippers in the form of lower rates.

Smarter Strategies to Reduce Your FTL Costs in Canada

Shippers seeking competitive FTL pricing in Canada should also evaluate their freight visibility tools and consider whether they are optimizing their shipping windows. Flexible pickup and delivery schedules often lead to better rates, especially in tight-capacity markets. Working with carriers that offer consolidated freight planning or shared truckload models can also reduce overall costs without compromising service levels. For example, companies shipping within Western Canada—especially in high-demand corridors like Vancouver to Calgary or Edmonton to Winnipeg—often turn to trusted regional carriers like Rolls Right with a reputation for reliability, flexible truckload capacity, and responsive service, Rolls Right helps businesses optimize delivery schedules while keeping Full Truckload shipping rates competitive.

What is the average rate for full truckload shipping per mile in Canada in 2025?

As of 2025, average FTL rates in Canada range from $2.10 to $3.50 per mile, depending on lane, region, and freight type. Rates fluctuate based on diesel fuel costs, demand, and specialized service requirements.

How can I reduce FTL freight costs in Canada?

Book in advance, be flexible with loading times, work with regional carriers, consolidate shipments, and consider carriers with route optimization technology or sustainability incentives.

Are full truckload shipping rates higher in Western Canada?

Not always. Rates in Western Canada vary by season and industry demand. Agricultural lanes may see spikes during harvest, while major lanes like Vancouver to Calgary are generally competitive due to consistent volume.

Does carbon pricing affect FTL shipping costs?

Yes. Carbon pricing policies can increase carrier operational costs, especially in provinces with stricter emissions rules. Some of these costs may be passed on through surcharges.