If you’re shipping freight in Canada in 2025, understanding how Full Truckload (FTL) and Less Than Truckload (LTL) costs are evolving can help you save money and stay competitive. This year has brought notable changes in rate structures, influenced by domestic policy, fuel prices, and increased use of digital freight tools. Here are five trends shaping Canadian FTL and LTL shipping costs right now.

1. Spot Rates and Cross-Border Trade Volatility

FTL spot rates across key Canadian lanes (e.g., Toronto–Vancouver, Calgary–Montreal) have been fluctuating between CAD $2.75–$3.25 per mile depending on season and capacity. Cross-border shipments to the U.S. are facing added costs due to customs clearance, regulatory changes, and U.S. tariff volatility. While Canada’s trade remains more stable, U.S. policy shifts continue to impact northbound and southbound freight rates.

Canadian businesses that rely on consistent cross-border shipping are now building more flexible supply chains. They’re diversifying routing options and exploring bonded warehouse setups to streamline customs and avoid unnecessary storage or demurrage fees.

2. Lack of Formal Freight Classification and Custom Pricing

Unlike the U.S., Canada doesn’t use a formal National Motor Freight Classification (NMFC) system. Instead, LTL carriers in Canada use negotiated pricing based on:

- – Shipment weight and dimensions

- – Lane distance

- – Freight class equivalents (if used for U.S. compatibility)

Canadian shippers should focus on accurate freight dimensions and leverage volume-based pricing or freight consolidation to control costs. Some carriers offer density-based discounts, but terms are less standardized than in the U.S. Proactively updating your TMS and educating warehouse staff on best packaging practices can make a measurable impact on shipping spend.

Additionally, ensure your quotes account for surcharges such as residential delivery, tailgate lift, and appointment scheduling—these extras often catch shippers by surprise and can increase LTL cost-per-pallet by as much as 15–20%.

3. Carrier Consolidation and Regional Capacity Shifts

Major players in the industry within Canada are optimizing regional hubs rather than expanding new terminals. LTL rate increases have averaged 4–7% in 2025, as carriers adjust for rising labour and equipment costs. For FTL, capacity constraints in Western Canada and the Atlantic provinces have resulted in spot premiums, especially for time-sensitive freight.

This regional imbalance is pushing some companies to evaluate alternate modes, including intermodal for long-haul freight and dedicated routes for consistent high-volume lanes. While these options require more planning, they can lead to greater cost stability in volatile markets.

4. AI and Digital Freight Platforms

Canadian shippers are increasingly turning to digital freight platforms like Loadlink, Rose Rocket, and TransCore to automate rate shopping and load booking. AI-based tools are also being integrated into TMS systems to:

- – Predict rate trends and optimize tendering

- – Improve load planning for FTL and LTL shipments

- – Reduce empty miles and rebalance lanes

Digital brokerage models are growing, especially for cross-border freight, where real-time visibility and rate flexibility provide strong advantages. By using AI-driven decision tools, even mid-sized businesses can access rates and service options that were once only available to large-volume shippers

5. Fuel Trends and Input Costs

Diesel prices in Canada have eased slightly in 2025, but remain elevated compared to pre-2023 levels due to global instability and refining bottlenecks. Fuel surcharges are typically based on rack pricing and adjusted weekly. Both FTL and LTL providers pass these costs to shippers via transparent fuel indexes.

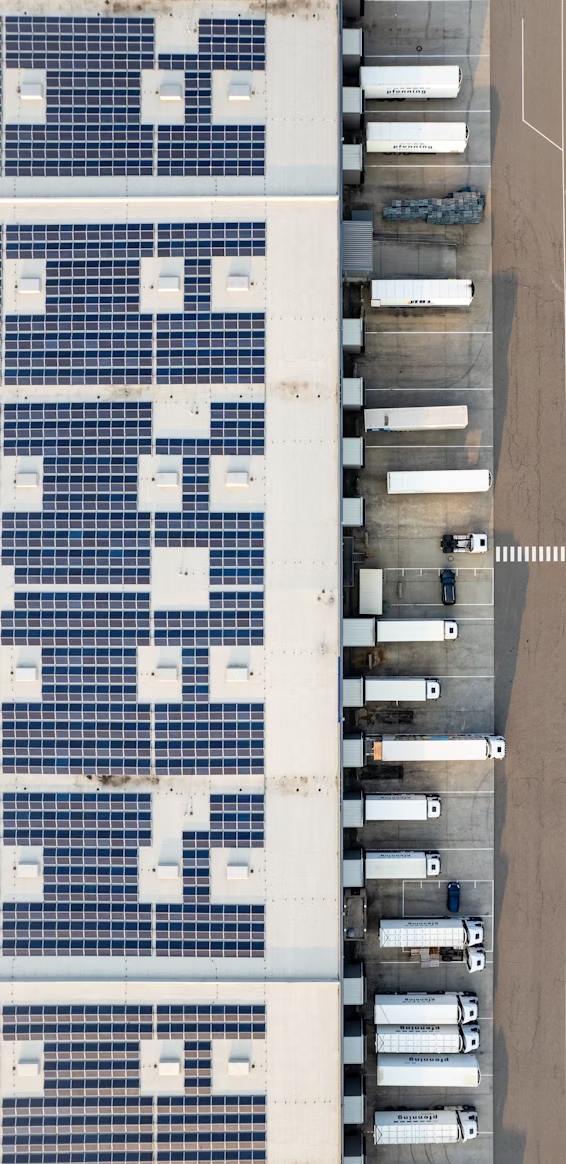

Carbon pricing and clean fuel standards in provinces like B.C. and Quebec also add to operational costs, especially for regional hauls. Consider working with carriers that use modern, fuel-efficient equipment or offer carbon-offset programs. Some shippers are starting to track emission data and sustainability metrics as part of broader ESG (environmental, social, and governance) initiatives.

Final Thoughts: How to Stay Ahead in Canada

To stay cost-effective in today’s Canadian freight market:

- Package freight efficiently and record accurate dims

- Use digital freight marketplaces for rate visibility

- Renegotiate contracts frequently to align with trends

- Consider mode shifting between FTL and LTL depending on demand and lane economics

- Work with carriers offering carbon-conscious options or hybrid delivery models

Need help navigating today’s freight landscape? Our experts specialize in Canadian and cross-border shipping. Get in touch for a customized quote today.